SafetyWing Review – Travel Insurance for Long-Term Travellers

Best Travel Insurance for Digital Nomads & Remote Workers

I’ve recently come across a travel insurance product that I’m extremely excited about!

SafetyWing is the first medical travel insurance created specifically by nomads, for nomads. SafetyWing insurance company provides coverage (and peace of mind!) for people from all over the world while they are outside their home country.

And although their travel insurance is aimed at remote workers and digital nomads, it can be used by anyone who is traveling for extended periods of time.

Their plans are comprehensive, easy to understand, and they provide a variety of coverage options – there’s a travel insurance plan that will work for almost everybody!

And yes, they cover COVID-19 related occurrences (which can be difficult to find in other insurance policies).

You’ll find below my detailed SafetyWing travel insurance review, updated for 2022, that focuses on their different travel insurance offerings (Nomad + Remote Health Benefits), the pros and cons of each, what exactly is covered, and how much they cost.

Quick Links – SAFETY WING TRAVEL INSURANCE:

Quick Links – SAFETY WING TRAVEL INSURANCE:

- WHY IS SAFETYWING THE BEST TRAVEL INSURANCE OPTIONS FOR LONG-TERM TRAVELERS? (QUICK SUMMARY)

- WHAT IS INCLUDED IN SAFETYWING TRAVEL INSURANCE COVERAGE?

- WHAT ARE THE DIFFERENT TYPES OF SAFETYWING TRAVEL INSURANCE??

- NOMAD INSURANCE – TRAVEL MEDICAL

- WHERE CAN I TRAVEL WITH SAFETYWING NOMAD INSURANCE?

- WHAT IS COVERED WITH SAFETYWING NOMAD INSURANCE?

- WHAT ARE THE EXEMPTIONS AND LIMITATIONS?

- IS COVID-19 COVERED?

- WHEN DOES COVERAGE BEGIN?

- CAN I CHOOSE MY OWN HEALTHCARE PROVIDERS?

- HOW DO I FILE AN INSURANCE CLAIM?

- OPTION 2 – SAFETYWING REMOTE HEALTH BENEFITS:

- WHERE CAN I TRAVEL WITH SAFETYWING REMOTE HEALTH INSURANCE?

- WHAT IS COVERED WITH SAFETYWING REMOTE HEALTH INSURANCE?

- WHAT ARE THE EXEMPTIONS AND LIMITATIONS?

- IS COVID-19 COVERED?

- WHEN DOES COVERAGE BEGIN?

- CAN I CHOOSE MY OWN HEALTHCARE PROVIDERS?

- HOW DO I FILE AN INSURANCE CLAIM?

- NOMAD INSURANCE – TRAVEL MEDICAL

- FREQUENTLY ASKED QUESTIONS – SAFETY WING TRAVEL INSURANCE

- IS TRAVEL INSURANCE REALLY NECESSARY?

- IS IT DIFFICULT TO SIGN UP FOR TRAVEL INSURANCE?

- CAN I CANCEL MY INSURANCE POLICY WHEN I WANT TO?

- ARE MY ELECTRONIC DEVICES COVERED?

- IS SAFETYWING NOMAD INSURANCE THE CHEAPEST TRAVEL INSURANCE ON THE MARKET?

- IS SAFETYWING NOMAD INSURANCE THE BEST TRAVEL INSURANCE OPTION FOR DIGITAL NOMADS?

- DO I NEED TO HAVE A POLICE REPORT IF MY ITEMS WERE LOST OR STOLEN?

- DOES SAFETYWING COVER MY SPORT OR ACTIVITY?

- FINAL THOUGHTS ON SAFETYWING TRAVEL INSURANCE

- CHECK PRICES FOR SAFETYWING TRAVEL INSURANCE HERE

![]()

Why is SafetyWing the Best Travel Insurance Options for Long-Term Travelers?

Why is SafetyWing the Best Travel Insurance Options for Long-Term Travelers?

(Quick Summary)

In my opinion, these are the reasons SafetyWing is the best long-term traveler insurance option:

- No Limit on Duration of Travel – Yup, it’s true! Unlike other travel policies that will only cover you for two or three months maximum, SafetyWing has no limit on the duration of your travel that they will cover! After one full year, you will need to renew your travel insurance policy, but that’s it.

- SafetyWing Insurance Includes COVID-19 Coverage – As long as COVID-19 was not contracted before your coverage began, you’re covered for COVID-19 and quarantine-related expenses. More information on that is below! (This is rare with other travel health insurance companies).

- You Can Travel With a One-Way Ticket – If you travel without a return ticket like we often do, then this could be a good option for you. Unlike most other insurance companies, SafetyWing will cover you even if you don’t have a planned return ticket.

- Provides Some Coverage in Your Home Country – SafetyWing will provide limited coverage when you return to your home country, which is rare in travel insurance providers, as long as the visit is incidental. After being abroad for 90 days, you’ll retain your SafetyWing medical coverage for 30 days in your home country in a 90-day period (15 if your home country is the USA) if you decide to return to your home country and something happens while you are there. (Note that you cannot be traveling to your home country for the purpose of obtaining treatment for an illness or injury that happened while abroad)

- Worldwide Coverage is Included – If you’re planning on traveling around and planning as you go, this is perfect for you as SafetyWing provides worldwide coverage almost everywhere!

- Monthly Insurance Payments – You can pay your insurance premiums monthly with SafetyWing! Many of their competitors require upfront payment for the entire length of your trip, so this is a huge bonus for many.

- Purchase Your Insurance Policy While Traveling – If you’re already at your destination, you can purchase SafetyWing travel insurance, no problem. This is really rare with other travel insurance providers who require you to purchase your travel insurance before departing your home country! When we arrived in Mexico, my Canada insurance covered us for two months, then we switched to SafetyWing after that expired with no issues whatsoever.

- Coverage is Instant – Such a huge bonus! Some policies by travel insurance companies begin immediately after purchase, but some require longer to kick in.

- Direct Billing – Yep! Saves so much time.

- Your Adventure Activities Are Included – SafetyWing will cover you for activities that other insurance providers will not, such as riding a motorcycle or scooter, horseback riding, snowboarding or skiing, scuba diving, and bungee jumping. (However, extreme sports are not covered; learn more about exclusions here).

- SafetyWing Insurance is Affordable – SafetyWing is able to keep their costs low by focusing on just the essentials needed by long-term travelers, such as emergency medical coverage, instead of trip cancellation and other costs that they’re not likely to need with their lifestyles. SafetyWing’s insurance options come at an affordable price – just $42/USD for four weeks of coverage. Compared to World Nomads, which costs about $120 for a standard plan and $210 for an upgraded plan, this is a steal of a deal.

- Simple and Clear Pricing – SafetyWing’s pricing structure is easy to understand, with no complicated quotes required or choosing between various “tiers” of coverage. This is definitely not true of the majority of travel insurance plans!

- No hidden costs – pricing is simply based on your age, and whether you include travel to the USA or not

- FREE Coverage for Your Kids – Coverage for up to two children under 10 years of age per family (one per each adult) is included for free.

- Travel Insurance Designed by Nomads, for Nomads – SafetyWing understands the needs of long-term travelers, remote workers, and digital nomads, and they’re consistently adapting their products to meet those needs.

![]()

What is included in SafetyWing Travel Insurance Coverage?

First things first, here is a high-level summary of what is covered by SafetyWing Travel Insurance:

Emergency Accident & Sickness Medical Expenses

Emergency accident and sickness coverage is usually the most important coverage of any travel insurance plan. If you become hurt, or sick, or require medical attention, your costs may be covered for these reasons up to $250,000. Some examples would be if you slip in the shower in your accomodation (just happened to a good friend of mine!), get food poisoning while traveling, find yourself in a car accident, etc. The last thing you want is a hefty medical bill. It’s incredibly important to make sure you’re covered for emergency accident and sickness expenses, as proper medical care can be very expensive around the world!

Coverage in Your Home Country

This is pretty rare with travel insurance companies, but SafetyWing even provides you with limited coverage while in your home country! SafetyWing was created by nomads for nomads and understands that these types of travelers will visit their home country once in a while, but that their travel is still not over. (I’m not aware of any other travel insurance providers who offer anything like this). (Note that home country coverage is incidental only. You cannot be traveling to your home country for the purpose of obtaining treatment for an illness or injury that happened while abroad. Coverage is only for a 30-day period in your home country in a 90-day period, or 15 days if your home country is the USA).

Emergency Evacuation & Repatriation

If it’s required for you to be sent home to your home country (or another country) for further or continued medical treatment, and are too sick to travel home normally as a regular passenger, SafetyWing will still cover you. This may be morbid (and often overlooked), but they also cover the repatriation of your dead body back home, which can be very expensive for your family.

Accidental Death and Dismemberment

If you are in an accident and lose a limb, or if you tragically arrive at your destination and then die, then SafetyWing will cover you. The loss must occur within 365 days after the accident date that caused the loss.

Kidnapping

SafetyWing’s Crisis Response Coverage protects against the rare chance of kidnapping while traveling. You may receive recompense for either your ransom amount or for loss of personal belongings that occur during a kidnapping.

Please note that crisis response does not apply in some countries, such as Afghanistan, Iraq, Pakistan, Nigeria, and Somalia.

This type of coverage appears to be rare/overlooked with other travel insurance providers as well.

Stolen or Lost Passport

This is one of the most common claims made by travelers! If your passport ends up lost or stolen, SafetyWing will cover you up to $100 to replace it.

Personal Liability

Personal Liability Insurance indemnifies you in the rare event that your own actions cause an injury or financial loss to someone else. This could include a vehicle accident that you were found to be the cause of. Coverage also includes your legal fees, which can often be sky-high!

What are the different types of SafetyWing travel insurance?

OPTION 1 – SAFETYWING NOMAD INSURANCE – TRAVEL MEDICAL:

Affordable travel medical insurance coverage for people from all over the world while outside their home country.

Who is Nomad Insurance for? This is a good option for people who are looking for a more simple, cost-effective medical health insurance policy while traveling for extended periods of time out of their home country. It’s the best long term for digital nomads, remote workers, long-term travel insurance for travelers, and anyone else planning to be out of their home country for a month or longer.

If you’re looking for a more inclusive insurance plan that covers extras such as dental care, vision care, health screenings, immunizations etc. then SafetyWing’s Remote Health Benefits Plan might be better suited for you!

Cost: Approx $42/USD per month on their subscription model ($77/USD per month if includes travel to USA) for ages 18-39 years old. See prices for other age groups here

Deductible: $250 deductible

Maximum Limit: $250 000 max limit

Where can I travel with SafetyWing Nomad Insurance?

You will be covered for travel anywhere in the world outside of your home country, except for the following: Cuba*, Iran, Syria, and North Korea.

* U.S. citizens with permission from the U.S. government may travel to Cuba.

What is covered with SafetyWing Nomad Insurance?

You’ll be covered for unexpected illness or injury, and medical emergencies, including expenses for hospital, doctor, and prescription drugs. If you become ill or injured, you’ll be covered for eligible medical expenses. It also provides emergency travel-related benefits, such as: emergency medical evacuation, bedside visits, travel delays, and lost checked baggage. During a natural disaster, Safety Wing covers a place for you to stay up to $100 a day for 5 days

For a complete list of exclusions and limitations please see this link: Description of Coverage.

What are the exemptions and limitations?

What are the exemptions and limitations?

Exclusions for SafetyWing Nomad Insurance include:

- Cancer treatment

- Routine check-ups

- Pre-existing conditions (Limited coverage for acute onset of pre-existing conditions, but not chronic or congenital conditions)

For a complete list of exclusions and limitations please see this link: Description of Coverage.

Is COVID-19 covered?

Yes! SafetyWing’s Nomad travel insurance coverage works the same for COVID-19 related illnesses as any other illness, as long as you do not contract COVID-19 before your coverage start date, and that it does not fall under any other policy exclusion or limitation.

Testing for COVID-19 will only be covered if the test is deemed necessary by a physician. Antibody tests are not covered.

Quarantine is covered outside of your home country for up to $50/day for a maximum of 10 days, as long as you have been covered by Nomad Insurance for a minimum of 28 days and that your quarantine has been mandated by a physician or governmental authority, due to testing positive or you are symptomatic and waiting for test results.

When does coverage begin?

Your coverage begins immediately! As soon as your application is sent in and payment is made, if you’re submitting from outside your home country.

Can I choose my own health care providers?

Yes, as long as the incident happens outside of the USA.

Anywhere else in the world that is covered, you may select the hospital, physician, or other medical care service providers of your choice.

How do I file an insurance claim?

You file a claim simply by filling out a WorldTrips claims form and uploading it with photos or screenshots of receipts to the online portal. You can read about the entire SafetyWing claims process here.

Check SafetyWing NOMAD Insurance Prices Here:

![]()

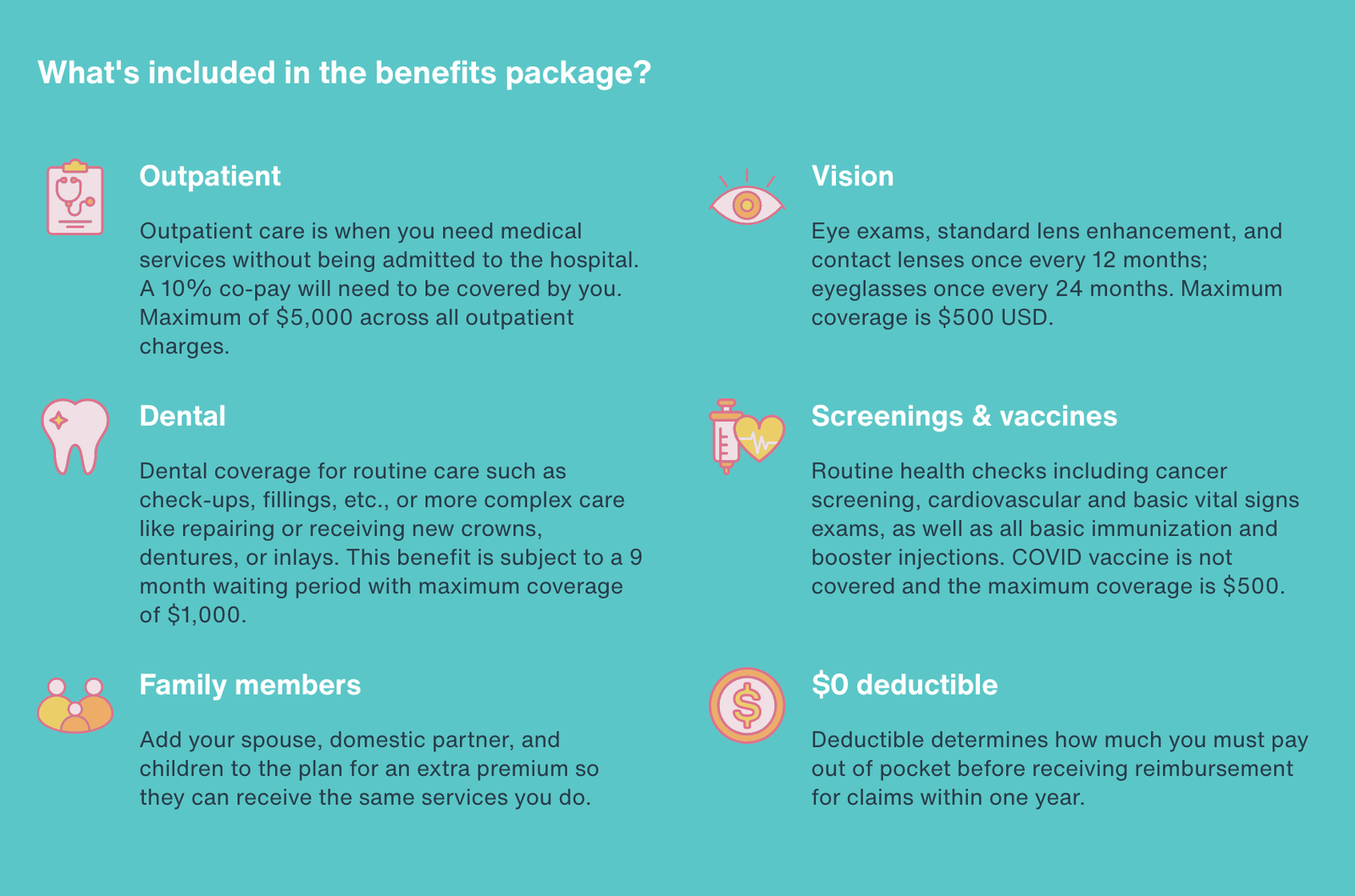

OPTION 2 – SAFETYWING REMOTE HEALTH BENEFITS:

Fully-equipped global health insurance benefits for remote workers and digital nomads who spend plenty of time abroad. Also includes full coverage in your home country!

Who is Remote Health for? This is an excellent full health insurance benefit plan for remote workers and digital nomads who spend plenty of time abroad.

If you’re looking for a more simple, medical-only insurance plan, then SafetyWing’s Nomad Medical Insurance plan might be better suited for you!

Cost: Approx $206/USD* per month for ages 18-39 years old. The exact price will depend on factors such as your age, your company size (if a company plan), and what add-ons you choose. See prices for other age groups here

*Note: Taxes, location and other factors could affect price.

Deductible: $0 deductible

Maximum Limit: $1,500,000 USD annual maximum

Where can I travel with SafetyWing Remote Health Insurance?

Coverage is for all countries!*

*excluding USA, Hong Kong, and Singapore, where you’ll receive limited coverage for trips up to 30 days

What is covered with SafetyWing Remote Health Insurance?

So much is included with the Remote Health plan, such as dental coverage ($1000 USD), vision coverage ($500 US), health screenings and vaccines ($500 US), hospital treatment and accommodation, inpatient surgery, ICU, cancer tests and treatment, reconstructive surgery, renal failure and dialysis, inpatient prescription medication, emergency ground ambulance, organ transplants, surgeries both day and outpatient, rehab, palliative care, and more. For extreme sports, everything is covered without limitations (unless the sport is performed in a professional capacity).

Most of this is covered at 100% as well. (Full details of coverage here.)

For a complete list of exclusions and limitations please see this link: Remote Workers Policy Document.

What are the exemptions and limitations?

Exclusions for SafetyWing Nomad Insurance include:

- Active duty, war & disturbances

- Administrative & non-medical fees

- Aesthetic treatments

- Expenses covered by third parties

- Maternity or newborn complications

- Professional sports

- Routine exams

For a complete list of exclusions and limitations please see this link: Remote Workers Policy Document

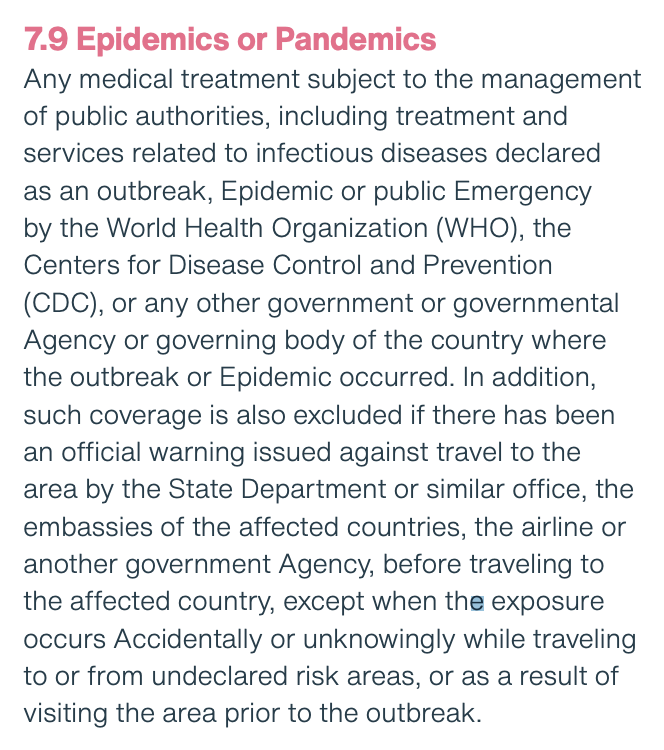

Is COVID-19 covered?

The below is taken directly from page 24 of the Remote Health’s Policy as of January 2022. COVID-19 vaccines are also not included. For a current, updated list of exclusions, please see: Remote Workers Policy Document

When does coverage begin?

Your coverage begins immediately, but some products may have a waiting period (such as a 9-month waiting period for Dental, and a 36-month waiting period for HIV-AIDS treatment).

Can I choose my own health care providers?

Yes, you can seek treatment at any registered hospital in the world. Direct billing is also possible.

How do I file an insurance claim?

You file a claim simply by filling out a WorldTrips claims form and uploading it with photos or screenshots of receipts to the online portal. You can read about the entire SafetyWing claims process here.

For hospitalizations and pre-planned treatment, payment for services can be pre-arranged directly with the hospital. For smaller unplanned treatments where you are not hospitalized, there is an online claims process. Reimbursement typically is within 15 days. Claims must be submitted within 180 days from the date of treatment for them to be eligible for coverage.

Check Prices for Remote Benefits Here

Get Great Hotel Discounts Using My Expedia Link:

Frequently Asked Questions – Safety Wing Travel Insurance

Here are the answers to some questions that are frequently asked by digital nomads and remote workers about travel insurance options:

Is travel insurance really necessary?

100%, completely, absolutely, yes. Unless you’re covered by some other provider (such as your credit card or employer), purchasing travel insurance is something I highly, highly recommend and cannot stress enough.

Is it difficult to sign up for SafetyWing Travel Insurance?

Absolutely not! It’s actually incredibly easy. First, you’ll create an account on SafetyWing’s website and choose an email address and password, or use your Facebook account to log in. After that, you’ll enter some details about yourself, such as your home country, your date of birth, and your mailing address.

When you’re ready to activate your insurance policy, you’ll simply choose your start date and specify whether you’ll be traveling to the United States or not. Here, you can also decide to add family members or friends to your travel insurance policy,

You can make your payment via credit card. You will be charged every 4 weeks as part of SafetyWing’s subscription model unless you decide to specify a specific start and end date for traveling and pay for it all upfront.

Can I cancel my insurance policy when I want to?

Yes, it’s also very simple to cancel your travel insurance policy at any time with SafetyWing. It just takes one single click, and you will still remain insured until the last day that you’ve paid for.

Are my electronic devices covered?

SafetyWing does not cover electronic devices. Most remote workers will have dedicated electronic devices insurance to cover their computers, cameras, hard drives, etc. If you have expensive electronic devices, I highly recommend finding comprehensive insurance coverage for them. My devices are insured as business items with my TD Bank insurance, but you will want to do lots of research and find the provider that works best for you and your situaiton.

Is SafetyWing Nomad insurance the cheapest travel Insurance on the market?

From my research so far, SafetyWing’s Nomad plan is indeed by far one of the most affordable long-term travel insurance options on the market today.

Is SafetyWing Insurance the best travel insurance option for digital nomads?

It’s impossible to say which travel insurance provider is the “best” overall, as it comes down to your own individual needs and situation. However, SafetyWing was created by nomads for nomads, so they definitely know what is important for long-term travelers when it comes to their travel insurance needs. Their customer service team is responsive, their plans are comprehensive and easy to understand, and the price point is wonderful.

Do I need to have a police report if my items were lost or stolen?

Yes, like most travel insurance providers, Safety Wing requires you to file an official police report in the instance of lost or stolen items.

Does SafetyWing Travel Insurance cover my sport or activity?

Travel insurance by SafetyWing does cover a wide range of sports and activities. They do not cover organized athletics or sports or activities performed professionally. They do cover for classes that you sign yourself up for at the gym, lessons with a personal trainer, and sporting activities performed with friends who get together regularly, as long as it is not “organized athletics”.

If you’re a professional athlete or instructor, you’re unfortunately not covered while performing your sport. You’ll be able to find other types of insurance to cover you in these instances.

Here is a list of recreational activities that are covered: (as per SafetyWing Insurance)

Here is a list of recreational activities that are covered: (as per SafetyWing Insurance)

- Angling

- Archery

- Badminton

- Ballooning

- Baseball

- Biking – includes touring and organized tours

- Bowling

- Bungee jumping

- Bushwalking up to 4,500 meters

- Camel riding/trekking

- Camping under 4,500 meters

- Canoeing

- Canyon swing

- Canyoning

- Capoeira dancing

- Clay pigeon shooting

- Cricket

- Cycling under 4,500 meters

- Deep-sea fishing

- Dirt boarding

- Dog sledding (not racing or competing)

- Fell running / walking

- Fencing

- Fishing

- Flying as a passenger

- Football (Soccer)

- Glacier walking up to 4,500 meters

- Golf

- Gymnastics (only as exercise or for fun; not competitive or organized)

- Hiking up to 4,500 meters

- Horse riding

- Hot air ballooning as a passenger

- Hunting (excluding big game)

- Ice skating (indoor or outdoor)

- Ice climbing up to 4,500 meters

- Jet boating

- Jet skiing

- Kayaking

- Land surfing

- Moped biking except as excluded below

- Motorbiking except as excluded below

- Mountain biking up to 4,500 meters

- Netball

- Orienteering

- Outdoor endurance except as excluded below

- Paintballing

- Rambling

- Rap jumping

- Rifle range shooting

- Rollerblading

- Roller skating

- Rowing / sculling

- Safari tours

- Sailing

- Sandboarding

- Sandskiing

- Scuba diving (sub Aqua Pursuits involving underwater breathing apparatus) as long as you are PADI/NAUI/SSI certified, or if you are not certified you are covered for up to 10 meters when accompanied by a certified instructor.

- Sea canoeing

- Sea kayaking

- Skateboarding

- Skiing (only covered for recreational skiing. No cover provided while skiing away from prepared and marked in-bound territories (off piste) and/or against the advice of the local ski school or local authoritative body)

- Sleigh rides

- Sledding

- Snorkelling except as excluded below

- Snow rafting

- Snowboarding (only covered for recreational snowboarding skiing. No cover provided while skiing away from prepared and marked in-bound territories (off piste) and/or against the advice of the local ski school or local authoritative body)

- Soccer (Football)

- Speed boating

- Squash

- Stand up paddle surfing

- Stilt walking

- Surfing except as excluded below

- Swimming

- Table tennis

- Ten pin bowling

- Tennis

- Trail bike riding

- Trekking up to 4,500 meters

- Tubing

- Tubing on snow

- Ultimate frisbee

- Via ferrata up to 4,500 meters

- Volleyball

- Wake skating

- Wakeboarding

- Walking

- Water skiing

- Weightlifting, cardio and classes at the gym (note that training for or attending a powerlifting competition is excluded.)

- Windsurfing

- Yachting (coastal waters only)

- Yachting (outside coastal waters)

- Yoga (in class or alone)

- Zip line

- Zorbing

Excluded Sports:

Excluded Sports:- All-Terrain Vehicles

- American Football

- Aussie Rules Football

- Aviation (except when traveling solely as a passenger in a commercial aircraft)

- Base Jumping

- Big Game Hunting

- Bobsleigh

- Boxing

- Cave Diving

- Cliff Jumping

- Heli-Skiing

- Heli-gliding

- Hot Air Ballooning as a Pilot

- Ice Hockey

- Kite-Surfing

- Martial Arts

- Luge

- Motorized Dirt Bikes

- Mountaineering at elevations of 4,500 meters or higher

- Outdoor Endurance Events

- Parachuting

- Parasailing

- Powerlifting (lifting at max weight with the intention of attending a competition)

- Quad Biking

- Racing by any Animal, Motorized Vehicle, or BMX, and Speed Trials and Speedway

- Rugby

- Running with the Bulls

- Skeleton

- Skiing off piste (outside prepared and marked in-bound territories) and/or against or against the advice of the local ski school or local authoritative body

- Snowboarding off piste (outside prepared and marked in-bound territories)and/or against or against the advice of the local ski school or local authoritative body

- Sky Surfing

- Snow Mobile

- Spelunking

- Sub Aqua Pursuits involving underwater breathing apparatus (unless accompanied by a certified instructor at depths less than 10m, or PADI/NAUI/SSI certified)

- Tractors

- Whitewater Rafting

- Wrestling

For a complete list of exclusions and limitations please see this link: Description of Coverage.

![]()

Get Great Hotel Discounts Using My Expedia Link:

Final Thoughts on SafetyWing Travel Insurance

Life is truly unpredictable. You’ll never know when you end up sick, have an accident, or bad luck simply strikes. When the worst does happen, it’s a terrible feeling to realize you’re not covered and unprepared to pay for the costs required to seek treatment or help – especially costs that could easily have been avoided with the quick, easy and affordable purchase of travel insurance (such as Nomad Insurance or Remote Benefits by SafetyWing).

Purchasing peace of mind with travel insurance is so very important, whether you’re moving to a new country, working remotely as a freelancer, moving around the world as a digital nomad, or simply spending an extended amount of time abroad.

I hope your future travels are fulfilling, and I hope you’ll never see the day when you actually need to make a claim using your travel insurance!

Explore Nomad Travel Insurance

PIN FOR LATER

![]()

Disclaimer: This blog post may include affiliate links. At absolutely no extra cost to you, I may receive a small commission for any purchase made through these links. Any commissions received are very much appreciated, as they help me to be able to continue posting travel blog content free of charge to my lovely readers. Of course, all recommendations are unbiased, and I will always only recommend products and services that I truly believe in. Thank you for your support!

![]()

leave me a comment